SELLING YOUR HOME: A STEP-BY-STEP APPROACH

Whether you’re starting a family, moving for your job, getting ready to retire or embarking on a new chapter in your life, when your home no longer suits your current situation, it’s time to think about selling it. Although this can be a bit complicated, with the help of your agent, you can minimize the hassles, get the best possible price, and shorten the distance between “For Sale” and “Sold”.

Price it right

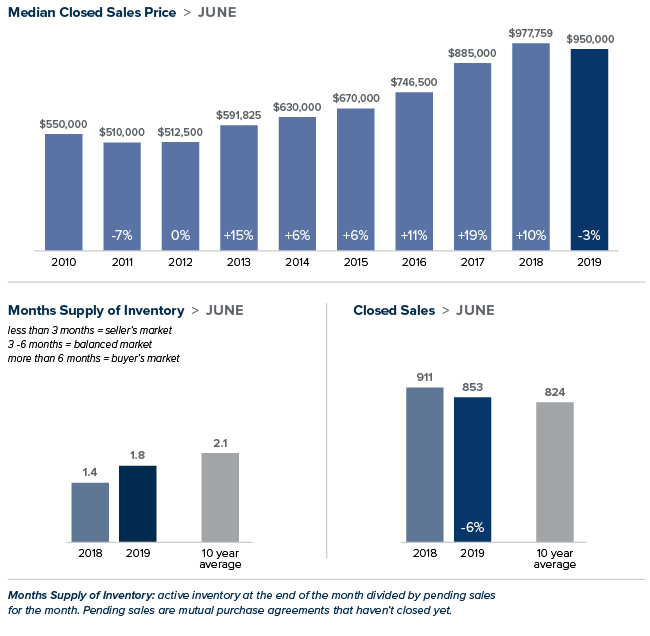

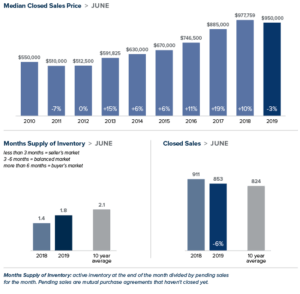

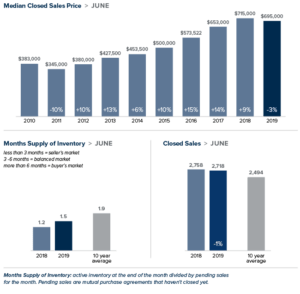

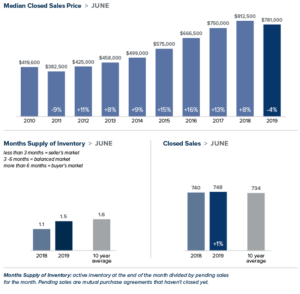

If you want to get the best possible price for your home and minimize the time it stays on market, you need to price it correctly from the beginning. Your agent can give you a clear picture of your particular market and can provide you with a comparative market analysis (CMA). A CMA contains detailed information on comparable homes in your area, including square footage, date built, number of bedrooms, lot size and more. It lists pending sales and houses sold in your area in the past six months, along with their actual sale prices.

By comparing your home to similar homes in your neighborhood and reviewing their list prices and actual selling prices, your agent can help you arrive at a fact-based assessment of your home’s market price.

Prepping your house for sale

You want to make a positive first impression when you list your home for sale. Here are some tips on how to enhance your home’s best features:

Work on your curb appeal

Some great things to improve your home’s curbe appeal are to get rid of moss on your roof, power wash your front walk, porch, deck and patio. Clean up the garden and mow the lawn, trim the hedges, weed the flowerbeds and add spots of color with container plants. Clean all the windows inside and out and repair them if they don’t open and close easily.

Refresh, repair and repaint

This goes for interiors and exteriors. If you see peeling paint, add a fresh coat. If it isn’t already, consider painting rooms a neutral shade of white or grey. It’s also a good idea to make necessary repairs as you don’t want to turn off a buyer with a dripping faucet, a broken doorbell, a clogged downspout or a cracked windowpane.

Deep-clean, from floor to ceiling

Clean rugs, drapes and blinds, and steam-clean carpeting. Get rid of any stains or odors. Make sure kitchen appliances, cupboards and counters are spotless and that bathrooms shine.

Declutter and depersonalize

Clean, light-filled, expansive rooms sell houses. So be sure to downsize clutter everywhere in your home, including cupboards, closets and counters. You might also consider storing some furniture or personal items to make rooms look more spacious. Take advantage of views and natural light by keeping drapes and blinds open.

Show your house

After you’ve taken care of all the repairs and cleaning tasks outlined above, your home is ready for its close-up: an open house. It’s actually best for you and your family to leave when potential buyers are present so they can ask your agent questions. But before you go, you might want to:

- Take your pets with you

- Open the shades and turn on the lights

- Light a fire in the gas fireplace

- Bake cookies or use candles and plug-in’s

- Keep money, valuables and prescription drugs out of sight

Be flexible in negotiating

If you get offers below your asking price, there are a number of strategies you can try in your counteroffer. You could ask for full price and throw in major appliances that were not originally included in the asking price, offer to pay some of the buyer’s fees, or pay for the inspection. You could also counter with a lower price and not include the appliances. If you receive multiple offers, you can simply make a full-price counter.

Your agent can suggest other strategies as well and help you negotiate the final price.

If your house doesn’t sell or you’ve received only lowball offers, ask your agent to find out what these prospective buyers are saying about your house. It might reveal something you can consider changing to make your house more appealing in the future or switch up the marketing strategy a bit to better manage expectations.

Breeze through your inspection

When a buyer makes an offer on your home, it’s usually contingent on a professional inspection. A standard inspection includes heating and cooling, interior plumbing and electrical systems; the roof, attic and visible insulation; walls, ceilings, floors, windows and doors; and the foundation, basement and visible structure. The inspector will be looking for cracks in cement walls, water stains and wood rot.

You can always opt for having an inspection done prior to putting your house on the market, so you can address any potential problems in advance. Your agent can give you several recommendations for qualified inspectors in your area.

Close with confidence

Whether this is your first time or your tenth, your agent can help guide you though the complex process of selling a home. Moreover, he or she can answer any questions you may have about legal documents, settlement costs and the status of your sale.

Your agent’s expertise, resources and extensive network also work for you when you’re buying your next house. Even if you’re moving out of the area, your agent can refer you to a professional agent in your new community.

This post originally appeared on the Windermere.com blog.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link